Can You Buy Visa Gift Cards With Afterpay?

Afterpay is a service that allows you to shop online and pay off your purchases in four installments every 2 weeks. It’s a popular way to pay for your purchases without incurring interest.

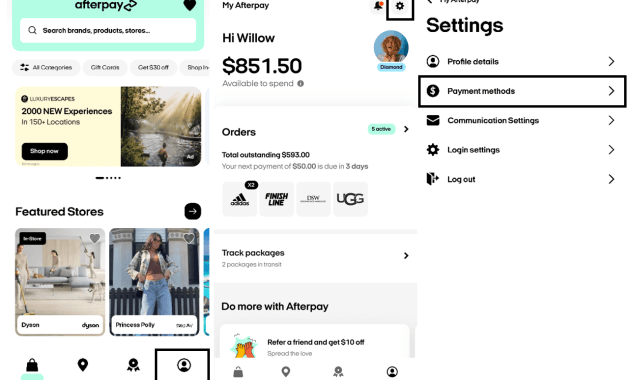

To use Afterpay, select it at checkout and register with your email address, mobile number and payment details. Afterpay will send you a reminder two days before your payments are due.

What is Afterpay?

Afterpay is a buy-now, pay-later service that offers delayed payments for purchases from a range of retailers. It’s designed to keep shoppers engaged with online stores by allowing them to make purchases without the need to apply for a credit card.

But there are some risks to buying things with a payment option like this, and it could lead to problems down the track if you don’t have the discipline to make repayments on time. That’s why it’s important to take a close look at your financial situation before using a buy-now, pay-later method.

The biggest risk with a buy-now, pay-later option is that it can make it too easy to spend more than you can afford. For example, if you buy a designer jacket with Afterpay, it’s tempting to spend all the money you have to spare on the item instead of saving that cash for an emergency fund.

If you’re not sure whether Afterpay is the right option for you, it’s a good idea to check out the company’s terms and conditions. This way, you’ll be able to understand exactly what the company is trying to protect itself from.

In addition, you should also check out Afterpay’s store directory to see if there are any retail shops near you that accept the service. The company has a range of retailers in its database, including smaller shops and Black-owned businesses.

However, there are some risks associated with using a buy-now, pay-later system, and it’s important to remember that these platforms won’t help your credit score. This means it might be a better idea to use an app like this when you need to shop for essential items, rather than impulse buys.

Can I buy a gift card with Afterpay?

Yes, you can buy a gift card with Afterpay at participating retailers. Just select Afterpay as your payment method when you checkout with the retailer and you’re good to go!

However, be sure to make your payments on time. Otherwise, you’ll owe a late fee worth $8 or 25% of the purchase value, and Afterpay won’t allow you to make any other purchases until you pay off your outstanding balance.

If you’re a savvy spender, using buy now, pay later services like Afterpay can help you save money and stick to a budget. The approval algorithm that Afterpay uses is designed to prevent you from buying something you can’t afford or biting off more than you can chew.

But if you’re an irresponsible spender or have a habit of not paying off your debts, using Afterpay could be risky. As well as interest charges, a late fee can also be applied to your account if you miss an Afterpay payment.

To avoid late fees, Afterpay suggests linking your account to your bank debit card from the start, rather than using a credit card. It’s a good idea to set up automated payments, too, so you don’t fall behind on your payment plan.

You should also take the time to set a budget for your Afterpay payments. Afterpay recommends you keep track of your spending and set aside money to pay off your Afterpay balance at the end of each month.

You can even earn rewards for making on-time payments with Afterpay’s Pulse program, which lets you accumulate points that can be redeemed for more payment flexibility or cashed in for gift cards. This perk is unique among BNPL providers, so it’s a great incentive to use Afterpay responsibly.

Can I buy a gift card with Sezzle?

If you’re looking for a way to purchase gift cards with afterpay, there are several ways that you can do so. Some of these methods involve using a credit card and others are completely free.

First, you need to sign up for an account with Sezzle and then link your debit or credit card. Then, you can start shopping for items with any of the merchants that have partnered with Sezzle.

Unlike other buy now, pay later services, Sezzle only works with its own network of approved merchants. This means that you won’t be able to shop at Amazon, Best Buy or other stores that aren’t part of the Sezzle network.

Once you’ve signed up, you’ll receive an initial spending limit that is based on your credit score and the company’s assessment of your repayment history. As you make payments on time, your limit should increase.

However, if you fail to make your payment or miss a scheduled installment, you’ll be charged a late payment fee. This fee is separate from any fees that your bank might charge you for overdue payments.

In addition, you can reschedule your payments for up to two weeks before the original due date. This can help you avoid the $10 late payment fee or a nonsufficient fund charge from your bank.

While rescheduling your payments is free, you can only use the service once per order. Any additional reschedules will incur a $5 fee.

If you have a limited budget, Sezzle offers a one-size-fits-all loan plan that includes a 25% down payment and three equal installments paid over six weeks. These interest-free payments are made by linking to your bank or credit card account.

Can I buy a gift card with Shop Pay?

Shop Pay is a new payment method that allows customers to use their credit or debit cards in stores. It works just like PayPal, but instead of a password or username, you enter your card details. This makes it easier for merchants to accept, as they don’t have to worry about storing customer data.

However, there are a few things you should know before buying a Visa gift card with Shop Pay. First, you need to make sure it’s activated and that you know the balance. You can check this by calling the number on the back of the card or by checking your account online.

You should also make sure that you have enough money to cover the total amount of the purchase. You should also be aware of any replacement fees and fraud protections that may apply to the card you’re purchasing.

Lastly, be sure to select the appropriate currency and shipping option at checkout. This is essential to ensure that your purchases are delivered safely and securely.

Another feature that’s useful for Shop Pay users is the ability to split your purchase into four equal, bi-weekly installment payments. This is a great way to spread out your payments and avoid interest charges or late fees.

In addition, you’ll get a notification when your next payment is due so that you can take action. Finally, you’ll have the option of choosing a payment date that fits your schedule.

Using a Visa gift card with Shop Pay can be a great way to purchase gifts for people who love online shopping. It’s a secure method of payment and can be used anywhere Visa cards are accepted.

Can I buy a gift card with Klarna?

If you want to buy a gift card with Klarna, the first thing you need to do is add a payment method. This can be done directly from the retailer’s checkout page in the Klarna app or from within your account.

When you shop online with Klarna, you can select a payment plan that allows you to pay for your purchase over time. These plans are called ‘buy now, pay later’ (or ‘BNPL’) payments.

The main benefit of this type of payment is that it lets you decide whether or not to keep the item before you actually pay for it, which can save you money in the long run. It also means that you don’t have to worry about interest fees on the amount that you owe as well as late fees and penalties.

To use a payment plan, you’ll need to be over 18, have a valid debit or credit card and be able to receive verification codes through email or text. These are required to verify your identity and to help you manage your repayments.

Once you’ve set up your account, you can view your payments and set new dates if needed. However, if you miss any payments or make late ones, it may negatively impact your credit score and will result in a late fee being charged to your card.

You can also choose to repay your loan in three or four interest-free payments. This option is available for UK residents only and cannot be used in New Mexico or Hawaii.

To use Klarna, you need to be over 18 years of age, have a valid debit or credit card and an active email address. You can apply for a Klarna account by visiting the Klarna website or by downloading the app. Once you’ve created an account, you can browse and shop with Klarna from any device and from anywhere in the world.